Real Estate,

Real Possibility

At S2 Capital, performance is engineered through our people and processes. We focus on acquiring and operating value-add residential and industrial assets in high-growth markets. Behind every decision is a team of operators, strategists, and innovators committed to clarity, precision, and relentless execution because culture drives performance as much as data does.

Built to Challenge Convention

S2 Capital was founded in 2012 by Scott Everett with a vision to rethink how real estate creates value. What began in residential has evolved into one of the fastest-growing real estate platforms in the country, spanning both residential and industrial investments. Our growth has been fueled by a culture of accountability, curiosity, and collaboration, where every team member plays a role in challenging convention and delivering results.

From day one, we’ve focused on fundamentals—finding value at acquisition, avoiding trends, and underwriting with discipline. Torch, our proprietary technology platform and analytics engine, powers this approach by analyzing everything from macroeconomic indicators to property-level operations. The result: a strategy designed for clarity, speed, and resilience.

Our Differentiator

We don’t follow trends—we find value others overlook. Every investment begins with exhaustive due diligence, combining disciplined underwriting with deep operational analysis. We scrutinize everything from macroeconomic trends and supply dynamics to property-level performance before committing capital.

Acquire

We source opportunities others overlook. By combining proprietary analytics with local market insight, we target high-growth markets that consistently outperform national averages in population, job, wage, and home value growth, such as Texas, Florida, Arizona, Colorado, Georgia, and North Carolina. Our acquisitions strategy centers on finding undervalued residential and industrial assets priced below replacement cost and underwriting for resilience. Torch helps power this process, analyzing everything from macroeconomic indicators to property-level performance to position every acquisition for success.

Reposition

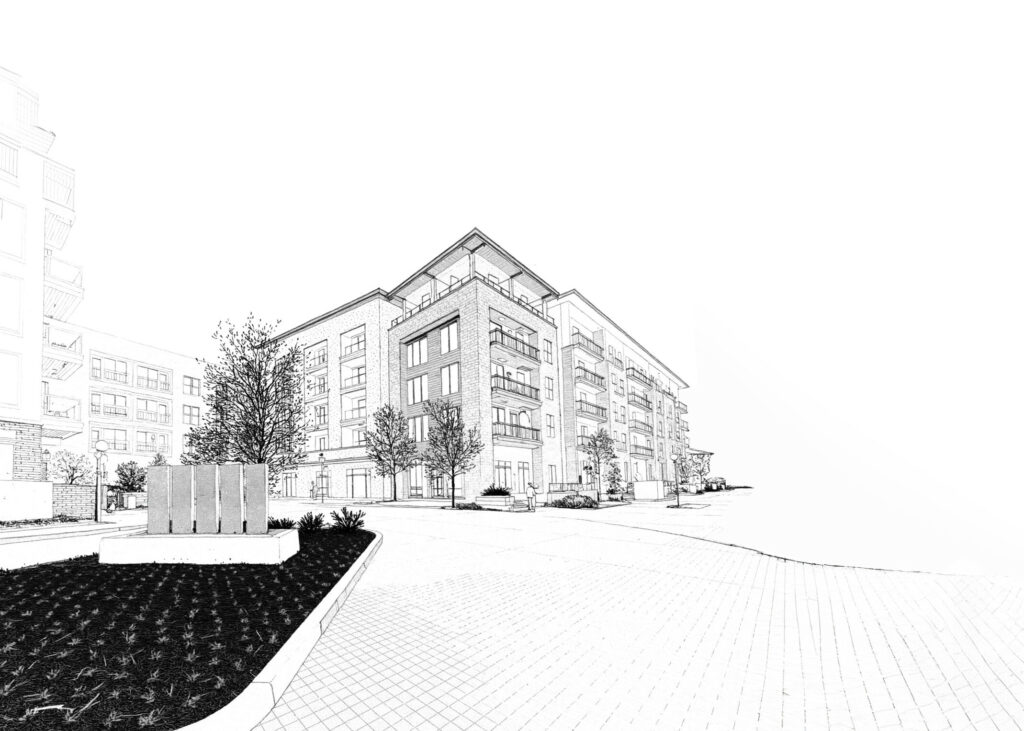

We transform potential into performance. We create value through operational improvements and strategic capital investments. Our tailored business plans enhance tenant experience and drive NOI growth through upgrades to interiors, amenities, and curb appeal—always calibrated to maximize ROI while preserving affordability. This approach is aimed to transform underperforming properties into high-performing assets without overextending capital.

Manage

We manage with precision and purpose. Our management philosophy is tenant-centric and performance-driven. We prioritize responsiveness, transparency, and operational efficiency, leveraging real-time data to optimize leasing, maintenance, and property operations. We believe strong tenant relationships and proactive oversight translate into higher retention, stronger cash flow, and long-term value creation.

Exit

We exit with discipline. Every decision, from acquisition to disposition, is informed by data and guided by strategy. Our goal is clear: deliver risk-adjusted returns that outperform expectations and endure through market cycles.

By the Numbers

Total Transaction Value

$12.5B+

Units Repositioned (Residential)

50,000+

Markets Nationwide

17

Employees

750

Investing Where Life Happens

Multifamily Property Management

S2 Residential manages multifamily communities with a clear purpose: to create living environments that drive both exceptional resident experiences and strong asset performance. Every improvement is intentional and designed to elevate the resident experience while strengthening long-term value.

We believe happy residents create strong returns. That’s why our teams deliver responsive service and proactive oversight, ensuring consistency across leasing, maintenance, and operations. Backed by real-time data and a commitment to disciplined execution, S2 Residential transforms underperforming properties into thriving communities.

Industrial Property Management

Fort Management is a specialized industrial property management platform built by operators. We believe property management should be treated as a service, not a cost center. We combine institutional-grade systems with a tenant-first approach to deliver operational excellence and real performance—not just rent collection.

Leveraging advanced technology, automated workflows, and real-time reporting, we protect assets, improve tenant retention, and enhance property-level cash flow. With in-house construction, maintenance, and accounting, we execute with precision and transparency, creating value in both stabilized and value-add environments. The target result: industrial properties that outperform traditional management standards and deliver lasting returns for owners and partners.

Built to Last

From one founder’s vision to a national platform, S2 Capital has grown by staying true to a core principle: performance is earned, not assumed. Every result reflects disciplined strategy, data-driven decisions, and relentless execution. As markets evolve, our commitment remains the same: protect downside, unlock opportunity, and deliver value that lasts.

See How We Operate